Breaking the Box: Reimaging Big Box Retail the Shoppers Stop 2.0 Way

From tech-powered personalization and private label expansion to omnichannel innovation and experiential store formats, Shoppers Stop’s transformative journey under Kavindra Mishra’s leadership is boldly evolving to meet the modern consumer expectations.

By Vaishnavi Gupta, Associate Editor

Jul 16, 2025 / 21 MIN READ

Shoppers Stop burst onto the Indian retail scene in 1991, planting its first flag in Andheri, Mumbai — and with it, rewriting the rules of how India shopped. At a time when shopping mostly meant crowded markets and no-frills stores, Shoppers Stop introduced something radical: a curated, air-conditioned retail haven that felt aspirational, luxurious, and entirely new. It wasn’t just a store — it was a bold statement. A pioneer. A game-changer that marked the dawn of modern retail in the country.

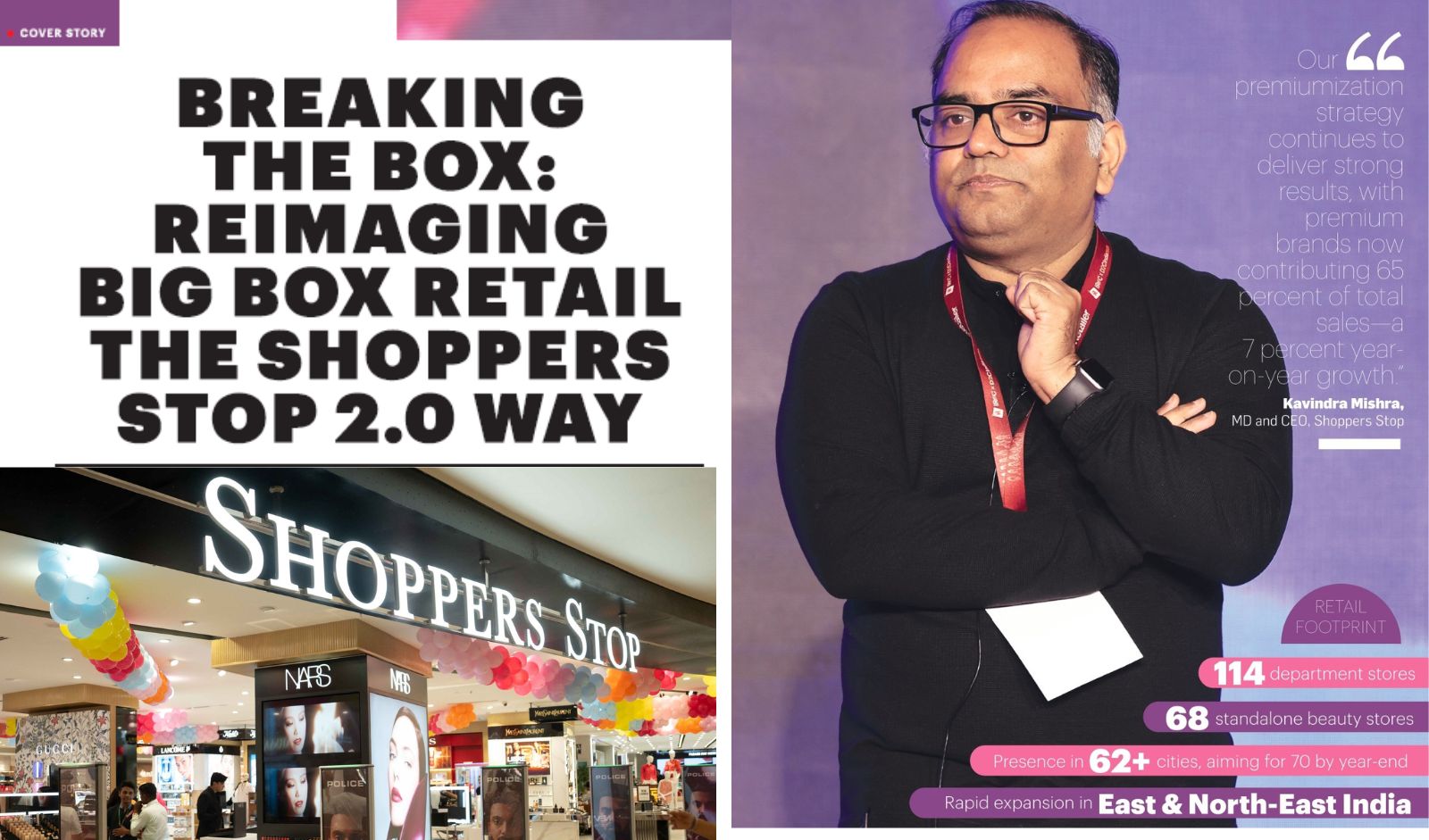

When Kavindra Mishra took over the role of MD and CEO of Shoppers Stop two years ago, his vision was clear: to reimagine the brand and build Shoppers Stop 2.0. “I'm proud to say we’ve already made significant strides in this direction. A perfect example is our flagship store in Malad’s Infiniti Mall, Mumbai. This store reflects the new face of Shoppers Stop—featuring the best global beauty and fashion brands, elevated store design, and an international retail experience. It’s a space that could easily compete with top retail environments anywhere in the world,” he said.

One of the strongest pillars of Shoppers Stop remains its loyalty program, with over 11 million First Citizen members, contributing to 78 percent of its overall business. Even more compelling is that 69 percent of its revenue comes from repeat customers, underscoring the strength of its customer relationships.

What sets the company apart today is the depth of customer data it holds. Through its advanced persona program, Shoppers Stop has segmented its 11 million customers using AI and machine learning, allowing it to personalize experiences and drive engagement in ways few retailers can match.

Premium Retail Reinvented

As customer expectations evolve, so must retail formats. Today, retail is no longer just about transactions—it’s about creating a meaningful and seamless experience for the customer. It's about providing comfort, warmth, and empathy at every touchpoint. Shoppers Stop’s journey towards premiumization is a key part of this transformation.

It is not just enhancing its product offerings or upgrading its store aesthetics—the company is focused on elevating the entire shopping experience. One of the ways it is doing this is through the personal shopper program. “While only 3 percent of our store associates are personal shoppers, they contribute to nearly 25 percent of our total sales, demonstrating the immense value of personalized service and deep customer understanding,” stated Mishra.

The company’s Malad store sets a new benchmark in experiential retail. One standout feature is a thoughtfully designed kids’ play area that has significantly enhanced the shopping experience for young families. “The response has been overwhelmingly positive, prompting us to roll out similar play zones across 40 stores this summer. Additionally, a newly introduced gaming arcade in the Malad store is drawing multi-generational engagement—parents and children playing together, redefining the purpose of a retail visit,” he explained.

Recognizing that customer journeys are increasingly omnichannel, the company is also upgrading its digital presence. The new Shoppers Stop 2.0 app will be launched soon, aimed at delivering a more intuitive and elevated online shopping experience.

Its premiumization strategy continues to deliver strong results, with premium brands now contributing 65 percent of total sales—a 7 percent year-on-year growth.

Tech-Driven Personalization

Shoppers Stop is deeply focused on leveraging technology to enhance the customer experience. All its stores are now omni-enabled, allowing customers to shop seamlessly across channels—for instance, buying online and picking up from the store. The company is also piloting innovative features such as scan-and-assist, where scanning a product tag instantly notifies a personal shopper, who then brings the item directly to the customer, offering a personalized and frictionless experience.

“Our personal shopper program is a cornerstone of our premium customer engagement. Each personal shopper is equipped with a dedicated personal shopper app, which provides deep customer insights—including purchase history, preferred brands, last visit details, and even likely future preferences. This allows them to curate a truly personalized shopping journey, elevating the overall in-store experience. In FY24 alone, our 450 personal shoppers were responsible for over Rs 1,000 crore in revenue—a testament to the effectiveness of this approach,” stated Mishra.

Beyond fashion, Shoppers Stop is also enhancing the experience in categories like beauty, with innovations like Fragrance Finders that help customers discover perfumes tailored to their preferences.

Growing Cityscape Presence

Shoppers Stop currently operates 114 department stores, along with several airport locations and 68 standalone beauty stores. Additionally, it has introduced a value fashion format called 'Intune', with 75 stores already up and running.

“A major focus area for us is the East and North-East regions of India. We’ve recently opened stores in Silchar, Agartala, and Shillong, and are set to launch in Dibrugarh shortly. We’re also seeing strong traction in cities like Ranchi, where we’re preparing to open our third store, and are soon entering Srinagar as well,” he asserted.

As of now, the company is present in over 62 cities, and by the end of the year, it expects to expand that footprint to nearly 70 cities.

Omnichannel Growth Drive

Currently, around 4–5 percent of its business comes through its omnichannel efforts. Unlike e-commerce marketplaces that operate by buying and selling across multiple third-party brands, or brand-owned platforms that control their entire product ecosystem, Shoppers Stop is a multi-brand retailer—it doesn’t own the brands it sells.

“That said, we are actively building our omnichannel capabilities, and the goal is to grow this contribution to 10–11 percent over time,” noted Mishra.

Café-Style Retail

To further enhance the in-store experience, Shoppers Stop has started integrating cafés into many of its high-street locations, creating a space where customers can relax, unwind, and enjoy their shopping journey. Currently, it has cafés in 8–9 of its stores, and this number is steadily growing.

“What sets this initiative apart is our collaborative and hyper-local approach. Instead of a one-size-fits-all model, we partner with café brands that resonate with the local audience. For instance, in Kanpur, we’ve partnered with Starbucks; in Mumbai, we’ve collaborated with abCoffee; and in Nagpur and Raipur, we’re working with well-loved local cafés,” he highlighted.

Customer-Led Assortment

Shoppers Stop is approaching brand curation in two key ways. Firstly, by bringing in exclusive international brands that have never before partnered with a departmental store in India. For instance, its collaborations with Armani and Prada in the beauty segment are exclusive to Shoppers Stop.

But its strategy isn’t limited to global brands. The company is also working to integrate emerging and beloved Indian labels into its ecosystem. A recent example is its collaboration with Suta. Interestingly, this was driven directly by customer feedback. “We engaged our shoppers to ask if they’d like to see sarees return to our offerings—something we used to sell two decades ago. The response was overwhelmingly positive, particularly from our Karnataka and Bengaluru stores, where customers even suggested specific brands. Based on this feedback, we’ve launched Suta in Chennai and our Bannerghatta Road store,” he said.

Shoppers Stop is also preparing to launch Taneira, further strengthening its ethnic wear portfolio. The idea is to localize the assortment based on what the customers truly want, and that’s where the “voice of the customer” plays a central role. “Our localization strategy ensures that stores in different regions reflect regional preferences and demand. For instance, while Suta has been welcomed in South India, our Delhi customers didn’t show strong interest in sarees, so we’ve held back on launching the category there—for now,” he further explained.

Private Brands Power

Its core strategy is to position Shoppers Stop’s private brands as a strategic growth engine. It’s not introducing products just for the sake of it. Instead, the company is filling gaps that existing brands in its portfolio don’t address—especially in categories where there's limited external brand availability. This approach not only strengthens the assortment but also helps drive higher gross margins.

One such area is Indian women’s wear and ethnic wear, which presents a significant growth opportunity, and Shoppers Stop is actively capitalizing on it. Similarly, kidswear is another promising category where it sees strong potential to drive business.

“We're also placing a renewed focus on men’s ethnic and occasion wear, and our private labels like Bandeya and Kashish are leading this charge. Both brands have performed exceptionally well—often outperforming national brands in their respective categories. While Bandeya caters to men’s festive and occasion wear, Kashish is our Indian ethnic wear brand for women, and both continue to deliver strong results,” stated Mishra.

Currently, about 18–19 percent of its apparel business comes from Shoppers Stop’s private brands, as these brands are exclusively focused on the apparel segment.

Forging the Future

One of its key strategic focus areas moving forward will be jewelry. Shoppers Stop sees significant potential in this category and began testing the segment two years ago with lab-grown diamonds, which have shown promising results. Given the early success, it is now doubling down on this initiative, and jewelry is poised to become a major growth driver for it.

The company is also observing a growing contribution from women’s wear and other women-led categories, which continues to strengthen its fashion portfolio. Additionally, handbags and footwear are high-priority categories for it. “As India embraces the shift towards casualization, we see strong opportunities in these segments and are working towards expanding our offerings to meet evolving consumer preferences,” noted Mishra.

Shoppers Stop burst onto the Indian retail scene in 1991, planting its first flag in Andheri, Mumbai — and with it, rewriting the rules of how India shopped. At a time when shopping mostly meant crowded markets and no-frills stores, Shoppers Stop introduced something radical: a curated, air-conditioned retail haven that felt aspirational, luxurious, and entirely new. It wasn’t just a store — it was a bold statement. A pioneer. A game-changer that marked the dawn of modern retail in the country.

When Kavindra Mishra took over the role of MD and CEO of Shoppers Stop two years ago, his vision was clear: to reimagine the brand and build Shoppers Stop 2.0. “I'm proud to say we’ve already made significant strides in this direction. A perfect example is our flagship store in Malad’s Infiniti Mall, Mumbai. This store reflects the new face of Shoppers Stop—featuring the best global beauty and fashion brands, elevated store design, and an international retail experience. It’s a space that could easily compete with top retail environments anywhere in the world,” he said.