GST Cuts Stir Dairy Boom

Major dairy players like Amul, Heritage Foods, and Milky Mist have slashed prices after the GST rate cut, making milk and milk products more affordable this festive season.

By Vaishnavi Gupta, Associate Editor

Nov 03, 2025 / 12 MIN READ

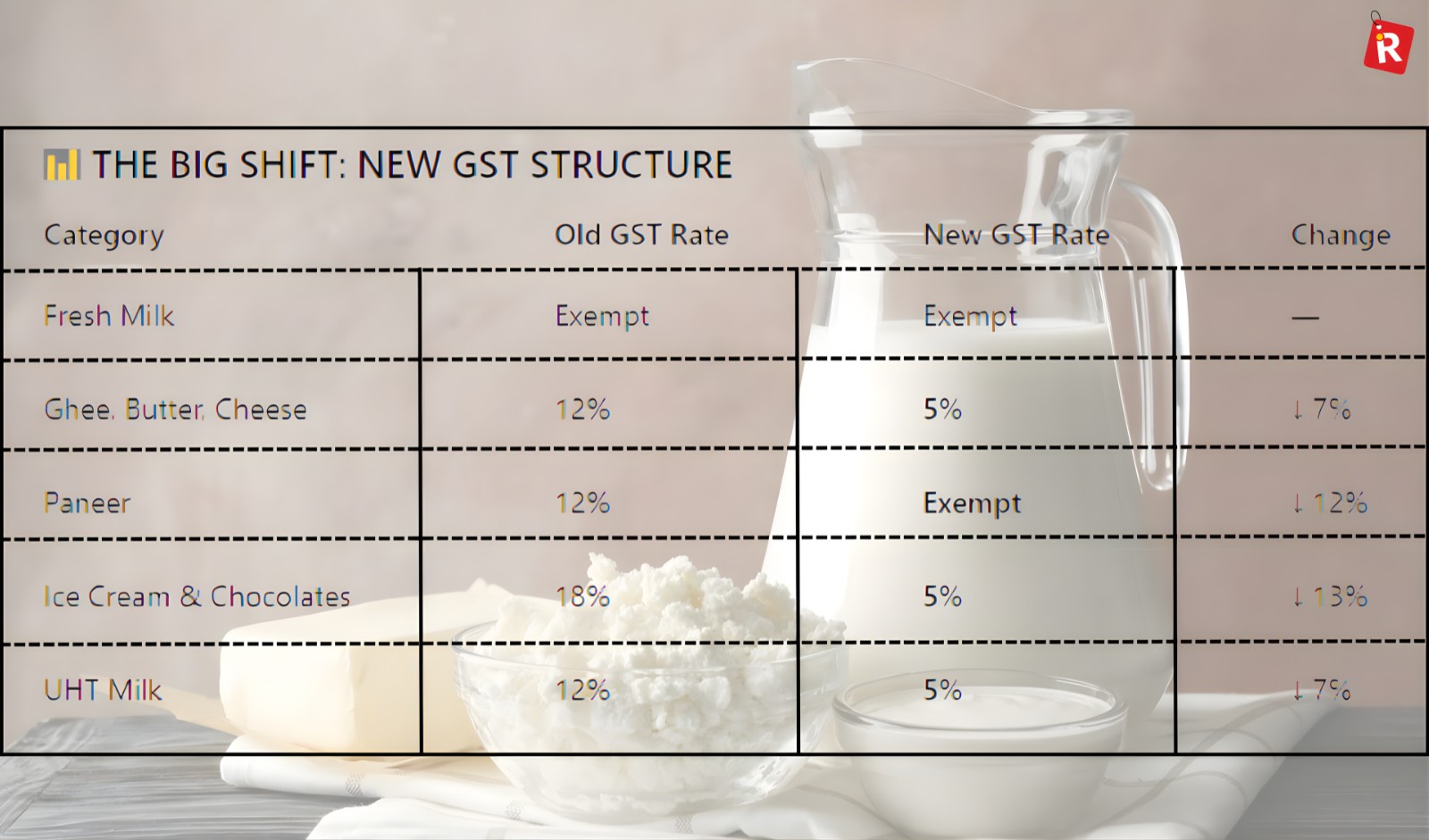

In a landmark move that could reshape India’s Rs 16 lakh crore dairy industry, the 56th GST Council has approved a rationalization of GST rates on milk and milk products — a decision that has already triggered swift and consumer-centric responses from some of the country’s biggest dairy players. Under the new structure, effective September 22, 2025, most dairy items either fall under the exempted category or are now taxed at just 5 percent.

Within days of the announcement, leading dairy brands — including Amul, Heritage Foods, Milky Mist, and Mother Dairy — revised their prices to pass on the benefits directly to consumers. In doing so, they have not only reinforced their consumer-first positioning but also signaled how swiftly India’s organized dairy sector can adapt to regulatory reform while balancing farmer welfare and market competitiveness.

Industry Rallies around a Common Goal

Few policy decisions have elicited such a uniform, positive response across the dairy ecosystem. Price revisions across categories have been significant. Ghee, butter, and cheese have seen reductions of around Rs 50 per kg, paneer prices have come down by Rs 25 per kg, and UHT milk by Rs 3 per litre. Even indulgence items such as ice cream and chocolate are now more accessible, with some brands cutting MRPs by Rs 20–35 per pack.

“The GST rate rationalization for India’s dairy industry is both timely and welcome,” noted Brahmani Nara, Executive Director, Heritage Foods. “By easing the tax burden on staples like paneer, ghee, butter, and cheese, the Government has made it possible for us to pass on the full benefit to our consumers. For us, this isn’t just about lower prices — it’s about ensuring that the purity and quality we stand for become even more accessible to families across India.”

Her sentiment is echoed by other industry leaders who view this reform as a turning point for the sector’s growth trajectory.

Boosting Demand, Supporting Farmers

The GST revision is more than just a consumer story. For brands like Amul and Milky Mist, it represents an opportunity to strengthen their dual commitment to affordability and farmer prosperity.

As a cooperative owned by 3.6 million farmers, Amul believes the tax cut will directly and indirectly benefit producers by increasing demand and channeling a greater share of consumer spending back to the source. With prices of Amul Butter reduced from Rs 62 to Rs 58 for a 100-gram pack and Amul Ghee now priced at Rs 610 per litre (down from Rs 650), the brand expects higher throughput across retail outlets.

Amul has lauded the government’s decision for “making nutrition more accessible and affordable” — a move it believes will spur growth in segments like ice cream, cheese, and butter, where per capita consumption in India remains relatively low.

South India–based Milky Mist, meanwhile, has taken the reform as an opportunity to balance consumer benefit with direct farmer support. Alongside reducing MRPs on more than 300 product categories, the company has also increased milk procurement prices by 7 percent in two tranches — first by 3.5 percent on September 1, and again after the GST revision.

“At Milky Mist, we are focused on our farmers and consumers,” said K. Rathnam, Whole-time Director and CEO of Milky Mist Dairy Food Limited. “By passing on the GST benefits and increasing procurement prices, we are ensuring equilibrium in the dairy ecosystem. This initiative is a step forward in creating trust and long-term partnerships.”

Retail Impact: More Competitive, More Inclusive

The GST rationalization is also expected to have a significant effect on the retail end of the dairy supply chain. For organized retailers, supermarkets, and modern trade outlets, lower prices could drive stronger offtake, particularly in value-added and impulse categories.

“This measure will positively impact the entire value chain — farmers will benefit from increased demand for packaged products, while consumers will gain from affordable pricing and greater access,” said Manish Bandlish, Managing Director, Mother Dairy. He added that the company has aligned its entire portfolio to ensure every product now falls either under the nil or 5 percent GST slab.

For consumers, the psychological impact of visible price reductions ahead of the festive season is likely to be significant. Retailers, in turn, stand to benefit from increased footfall and faster product movement. Lower MRPs can help drive higher volumes and cross-category sales during the high-demand festive months.

Festive Cheer and Beyond

With festive preparations in full swing, the timing of the GST revision couldn’t be better. Dairy products are central to Indian celebrations — from homemade sweets and festive feasts to gifting — and brands expect to see a sharp uptick in sales as consumers respond to lower prices.

For the government, this reform strengthens its position as a facilitator of equitable growth. For consumers, it brings tangible relief in everyday essentials. And for the dairy industry, it offers a platform to deepen trust, enhance accessibility, and reaffirm its role as a vital link between India’s farmers and households.

As Heritage Foods’ Brahmani Nara aptly put it, “Dairy is central to every celebration, from festive sweets to daily meals. With these reductions, the authentic taste and purity of dairy will bring added cheer to homes this season.”

In a landmark move that could reshape India’s Rs 16 lakh crore dairy industry, the 56th GST Council has approved a rationalization of GST rates on milk and milk products — a decision that has already triggered swift and consumer-centric responses from some of the country’s biggest dairy players. Under the new structure, effective September 22, 2025, most dairy items either fall under the exempted category or are now taxed at just 5 percent.

Within days of the announcement, leading dairy brands — including Amul, Heritage Foods, Milky Mist, and Mother Dairy — revised their prices to pass on the benefits directly to consumers. In doing so, they have not only reinforced their consumer-first positioning but also signaled how swiftly India’s organized dairy sector can adapt to regulatory reform while balancing farmer welfare and market competitiveness.

Related Stories

ndia’s activewear market is projected to grow from $15.1 billion in 2024 to nearly $30 billion by 2030, with women’s activewear and everyday bottomwear expected to lead growth. The athleisure boom is…

- By Richa Fulara

- |

- 12 Min Read

India’s luxury fashion industry is witnessing a strategic reset. After years of relying on fashion weeks, pop-ups, and multi-designer boutiques to build visibility, leading designers are now…

- By Vaishnavi Gupta

- |

- 8 Min Read

India’s consumption patterns are incredibly diverse, shaped by geography, seasonality, festivals, and even micro-markets. In such a dynamic environment, grocery retailers are increasingly relying on…

- By Richa Fulara

- |

- 8 Min Read