The Innerwear Revolution: India’s Next Retail Growth Story

Here we delve into how leading brands like Clovia, Rupa, Jockey and Juliet are driving the next wave of growth with franchise-led expansion and a strong focus on Tier II and III markets.

By Vaishnavi Gupta, Associate Editor

Nov 05, 2025 / 14 MIN READ

Once considered a quiet corner of the apparel industry, India’s innerwear market has emerged as one of its most vibrant growth engines. What was traditionally a necessity-driven category has now evolved into a style-conscious, comfort-led, and innovation-fueled segment—reshaping how consumers, especially women, perceive and purchase their intimatewear.

Industry estimates project the Indian innerwear market to reach $20.47 billion by 2030, growing at a CAGR of 7.6 percent from 2024 to 2030. The shift is driven by rising disposable incomes, heightened fashion awareness, evolving consumer lifestyles, and a growing emphasis on inclusivity, fit, and function.

Comfort, Confidence, and Choice

Across India’s metros and smaller cities alike, innerwear has transformed from a purely functional garment into a personal expression of comfort and confidence. As Shruti Khaneja, VP – Offline Sales at Clovia noted, “Demand in this category is being shaped by inclusivity, comfort, and fashion-forward design. Women today are seeking lightweight, seamless, and bonded fabrics that balance comfort with style.”

This sentiment resonates across the industry. Bhavesh Trevadia, Director at Juliet Apparels added, “Juliet isn’t just an intimatewear label anymore. We’re evolving into a dusk-to-dawn apparel brand for the modern Indian woman—from essentials to athleisure to fashion-led categories.”

Franchising: The Engine of Retail Expansion

One of the most notable trends in the industry’s recent evolution is the rise of the franchise model as a key retail growth lever. As competition intensifies and brands seek deeper regional penetration, franchising offers a scalable path to expansion—particularly in Tier II and Tier III markets where entrepreneurial energy meets aspirational consumption.

From Clovia’s FOCO model to Rupa’s franchise-led Exclusive Brand Outlets (EBOs) and Juliet’s experience-first store formats, brands are aligning franchise structures to ensure both consistency and profitability. Clovia has recently ventured into franchising, having launched more than 20 franchise outlets within just seven months of starting the initiative.

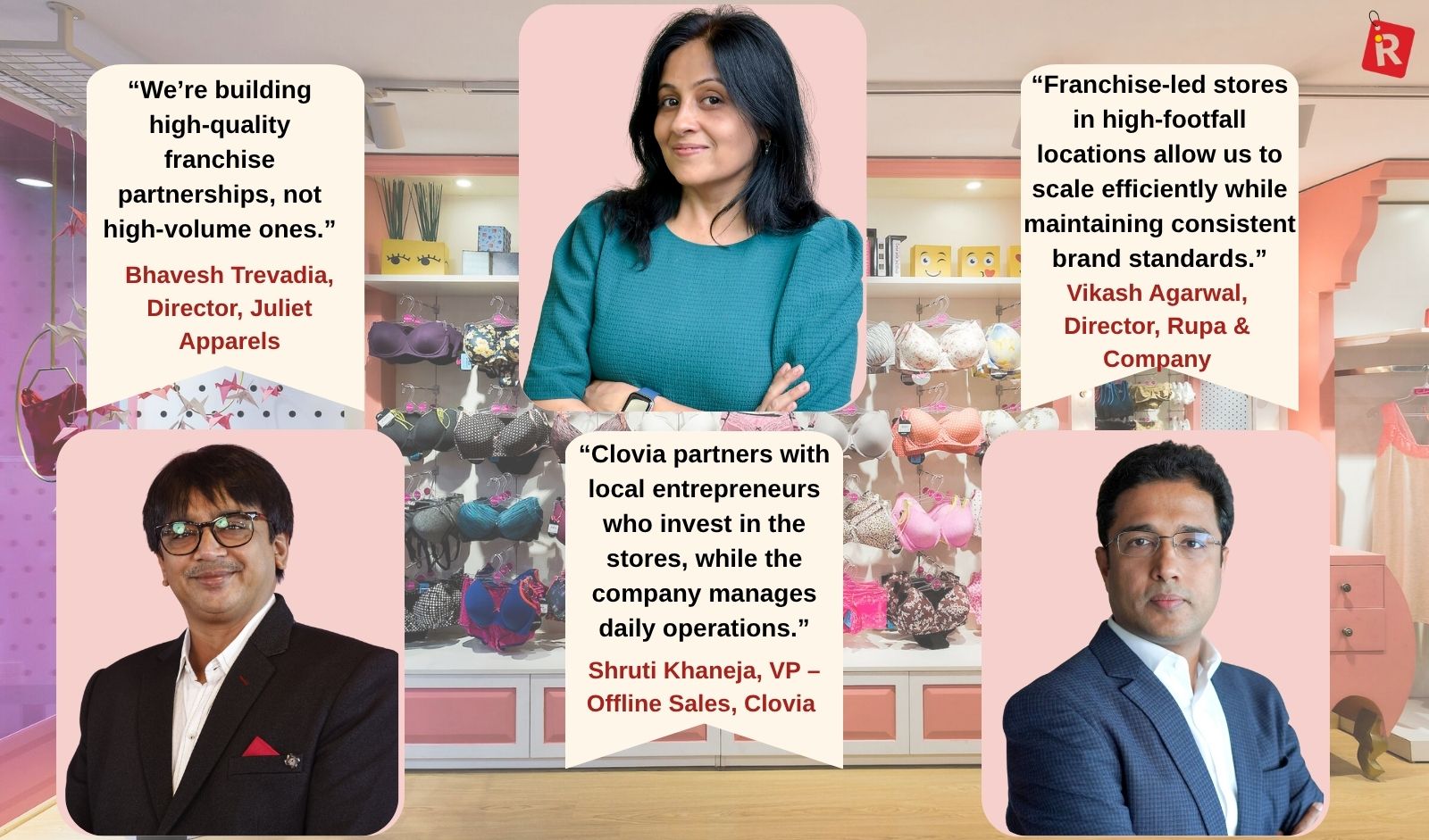

Khaneja elaborated, “Clovia partners with local entrepreneurs who invest in the stores, while the company manages daily operations. This approach enables scalable expansion and deeper consumer connections, even in markets where direct retail growth faces infrastructural challenges.”

For Rupa & Company, franchising has been equally pivotal. With 29 Exclusive Brand Outlets and a vast distribution network of over 1,500 dealers and 150,000 retail outlets, the company leverages a mixed strategy of direct presence, modern trade, and franchise-led retail. “Franchise-led stores in high-footfall locations allow us to scale efficiently while maintaining consistent brand standards,” said Vikash Agarwal, Director, Rupa & Company Limited.

Legacy brand Juliet also sees franchising as a cornerstone of its next growth phase. Its vision of building 50+ Exclusive Brand Outlets by 2027 is rooted in long-term partnerships rather than rapid rollouts. “We’re building high-quality franchise partnerships, not high-volume ones,” Trevadia emphasized.

Even global icons are doubling down on physical retail. Jockey, through its licensee Page Industries, recently celebrated the opening of its 1,500th Exclusive Brand Store in India—a remarkable milestone for a brand that opened its first store in 1995. As Ankur Sharma, Chief Retail Officer at Page Industries remarked, “This achievement is a testament to our consumers’ love and franchisees’ trust in the brand.”

The Rise of Tier II and III Retail Powerhouses

If metros once defined the growth of India’s innerwear market, smaller towns are now driving its next phase. As Trevadia observed, “India is not one retail market; it’s a mosaic of preferences, cultures, and fashion sensibilities. Our expansion focuses on fast-rising Tier II and Tier III hubs, while deepening presence in metro clusters.”

This sentiment is echoed across the board. For Clovia, South and East India represent high-potential growth regions, while Rupa continues to strengthen its foothold across the Hindi heartland and southern states through hybrid retail formats.

Product Innovation

Parallel to retail expansion, innovation in fabric technology and design continues to be a major differentiator. Leading brands are investing heavily in functional materials, ergonomic fits, and adaptive designs that cater to specific consumer needs.

At Clovia, the focus is on advanced technologies like bonded seamless fabrics, cushioned straps, breathable blends, and body-type-specific fits. Juliet’s newer collections extend beyond intimates into athleisure, loungewear, and fashion-first daily wear, aligning with evolving consumer lifestyles.

For Rupa, innovation comes through diversified sub-brands that address distinct demographics—from the DRY FIT collection under ‘Colors by Rupa’ to youth-oriented ‘Bumchums’ and women’s ‘Femmora’. “We are introducing fabrics with moisture-wicking, skin-friendly, and eco-conscious properties to ensure comfort and sustainability,” noted Agarwal.

Looking Ahead: Scaling the Comfort Economy

In terms of expansion, Clovia plans to expand its retail footprint through the Master Franchise model, appointing regional partners to manage clusters of stores for faster and more efficient growth. “Our goal is to establish 200 stores over the next 2–3 years,” highlighted Khaneja.

Meanwhile, Juliet’s ambition remains steady: 50+ EBOs by 2027, shaping the next era of modern, comfort-first women’s fashion in India.

Building on its strong FY 2023–24 performance, where Rupa & Co. recorded a standalone turnover of Rs 1,19,416.90 lakh and a net profit of Rs 6,912.08 lakh, the company plans to accelerate expansion across categories, retail, and franchising over the next 2–3 years. On the retail front, Rupa will deepen its omnichannel presence by expanding beyond its 29 Exclusive Brand Outlets, shop-in-shops, and online marketplaces. “Franchising will remain a key pillar, supported by robust operational, marketing, and technology assistance to ensure strong ROI for partners,” concluded Agarwal.

Once considered a quiet corner of the apparel industry, India’s innerwear market has emerged as one of its most vibrant growth engines. What was traditionally a necessity-driven category has now evolved into a style-conscious, comfort-led, and innovation-fueled segment—reshaping how consumers, especially women, perceive and purchase their intimatewear.

Industry estimates project the Indian innerwear market to reach $20.47 billion by 2030, growing at a CAGR of 7.6 percent from 2024 to 2030. The shift is driven by rising disposable incomes, heightened fashion awareness, evolving consumer lifestyles, and a growing emphasis on inclusivity, fit, and function.

Related Stories

ndia’s activewear market is projected to grow from $15.1 billion in 2024 to nearly $30 billion by 2030, with women’s activewear and everyday bottomwear expected to lead growth. The athleisure boom is…

- By Richa Fulara

- |

- 12 Min Read

India’s luxury fashion industry is witnessing a strategic reset. After years of relying on fashion weeks, pop-ups, and multi-designer boutiques to build visibility, leading designers are now…

- By Vaishnavi Gupta

- |

- 8 Min Read

India’s consumption patterns are incredibly diverse, shaped by geography, seasonality, festivals, and even micro-markets. In such a dynamic environment, grocery retailers are increasingly relying on…

- By Richa Fulara

- |

- 8 Min Read