Athleisure is becoming everyday clothing for many Indians. As more people choose comfort and versatility, brands offering practical, easy-to-wear products are seeing steady growth, making athleisure a regular part of daily wardrobes.

Athleisure is becoming everyday clothing for many Indians. As more people choose comfort and versatility, brands offering practical, easy-to-wear products are seeing steady growth, making athleisure a regular part of daily wardrobes. India’s luxury fashion industry is entering a new growth phase, with designers increasingly investing in flagship stores to gain greater control over brand storytelling, customer engagement, and long-term scalability.

India’s luxury fashion industry is entering a new growth phase, with designers increasingly investing in flagship stores to gain greater control over brand storytelling, customer engagement, and long-term scalability. AI is playing a pivotal role in scaling online grocery retail in India by helping platforms navigate the country’s highly fragmented and dynamic consumption patterns. From forecasting hyperlocal demand and managing perishability to optimizing supply chain

AI is playing a pivotal role in scaling online grocery retail in India by helping platforms navigate the country’s highly fragmented and dynamic consumption patterns. From forecasting hyperlocal demand and managing perishability to optimizing supply chain India’s fragrance market is no longer confined to deodorants picked up as an afterthought at the kirana or pharmacy counter. Over the last few years, perfumes have moved decisively into the mainstream, driven by changing consumer mindsets, deeper retail p

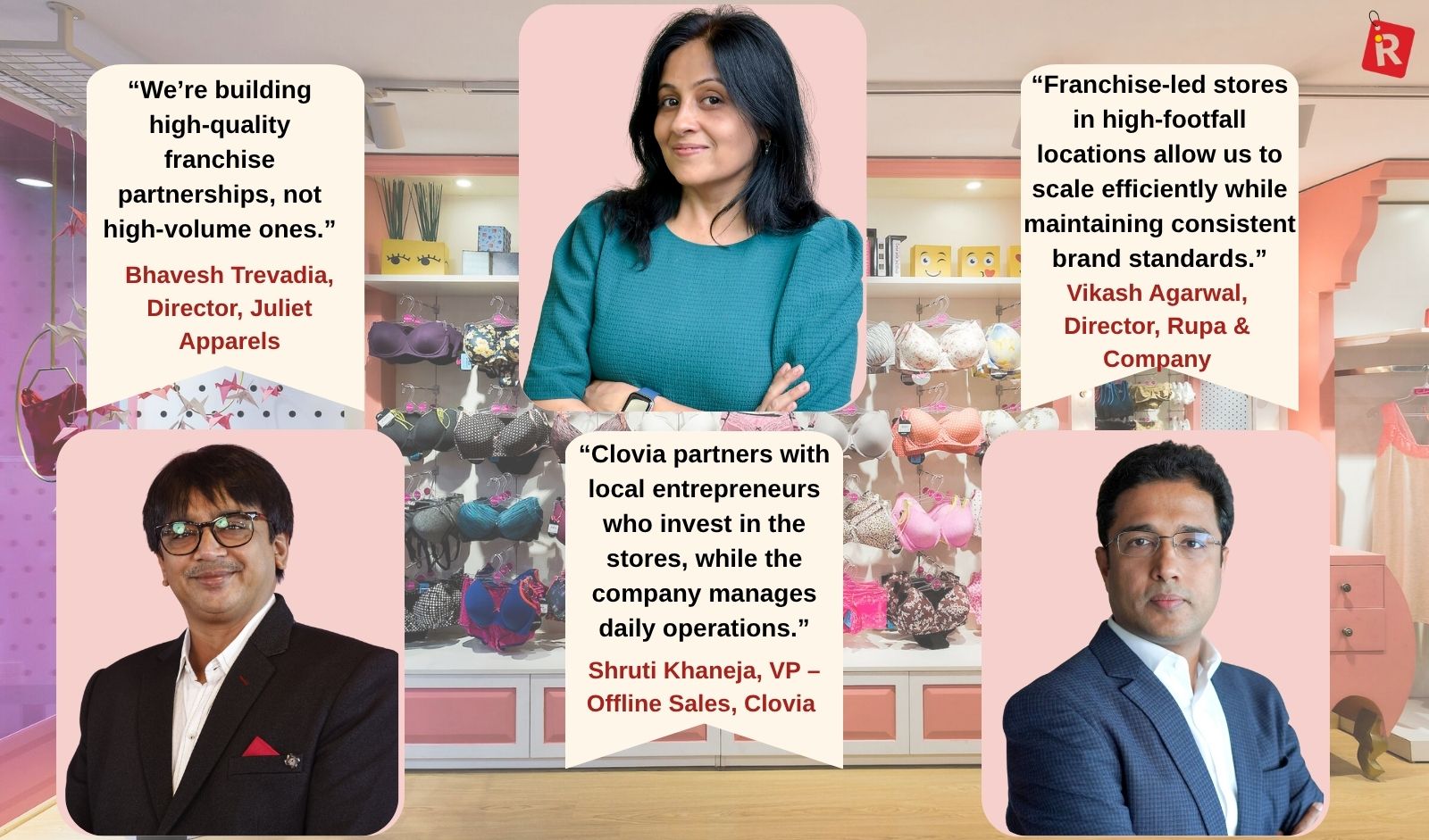

India’s fragrance market is no longer confined to deodorants picked up as an afterthought at the kirana or pharmacy counter. Over the last few years, perfumes have moved decisively into the mainstream, driven by changing consumer mindsets, deeper retail p Here we delve into how leading brands like Clovia, Rupa, Jockey and Juliet are driving the next wave of growth with franchise-led expansion and a strong focus on Tier II and III markets.

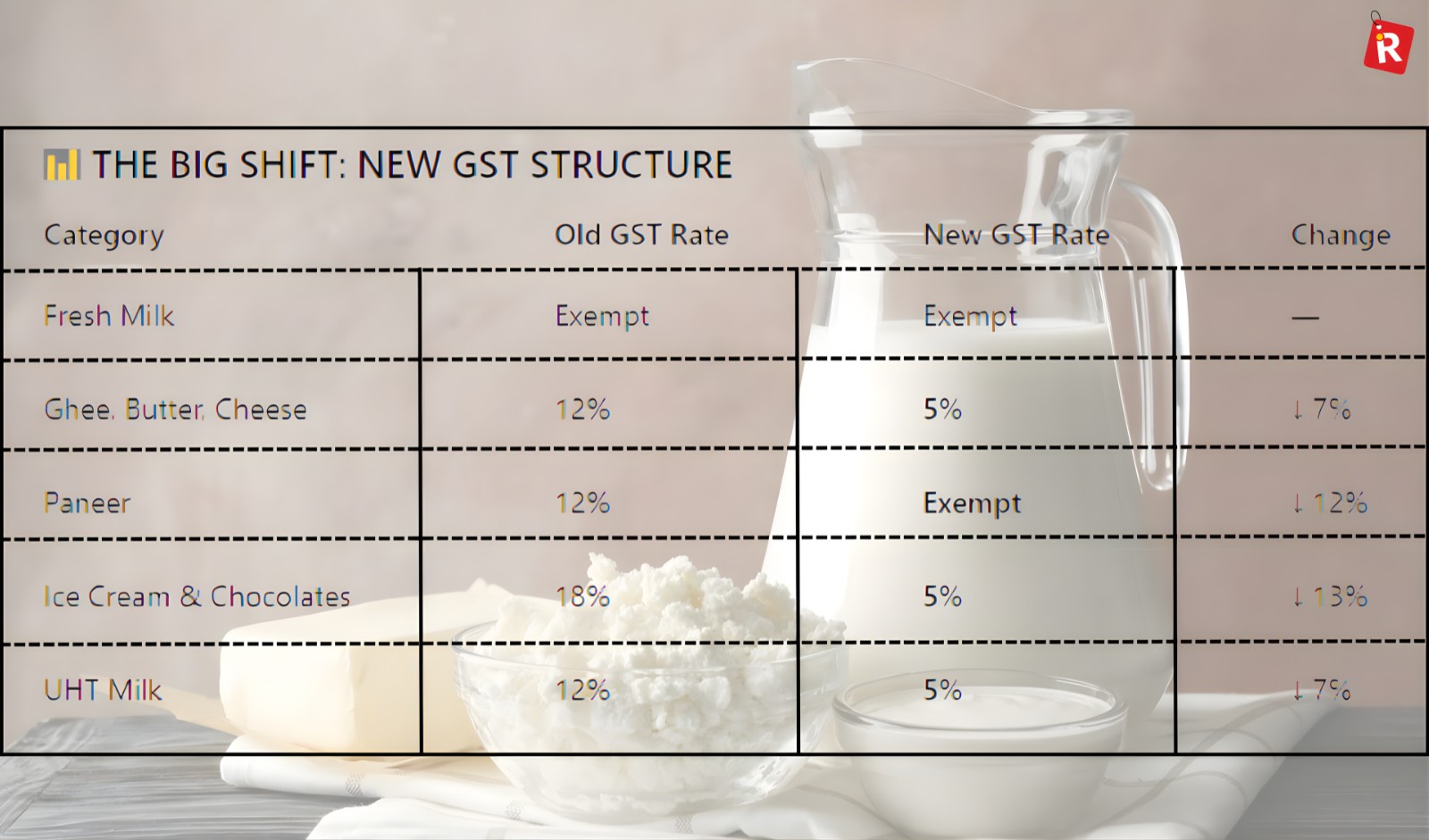

Here we delve into how leading brands like Clovia, Rupa, Jockey and Juliet are driving the next wave of growth with franchise-led expansion and a strong focus on Tier II and III markets. Major dairy players like Amul, Heritage Foods, and Milky Mist have slashed prices after the GST rate cut, making milk and milk products more affordable this festive season.

Major dairy players like Amul, Heritage Foods, and Milky Mist have slashed prices after the GST rate cut, making milk and milk products more affordable this festive season. Snacking in India is getting a healthy makeover. As more people choose mindful eating and nutritious options, homegrown brands are changing the way we think about snacks. From nuts and trail mixes to clean desserts and makhana-based treats, homegrown bran

Snacking in India is getting a healthy makeover. As more people choose mindful eating and nutritious options, homegrown brands are changing the way we think about snacks. From nuts and trail mixes to clean desserts and makhana-based treats, homegrown bran- K-beauty’s journey in India has shifted from fascination to fierce loyalty., with brands like Amorepacific and kindlife leading the charge.

India’s 13 million kiranas are rapidly going digital, blending tradition with tech to stay competitive in modern retail.

India’s 13 million kiranas are rapidly going digital, blending tradition with tech to stay competitive in modern retail. Instamart has transformed quick commerce in India from a bold experiment into a Rs 5,655 crore business that now serves over 11 million monthly users across 125+ cities.

Instamart has transformed quick commerce in India from a bold experiment into a Rs 5,655 crore business that now serves over 11 million monthly users across 125+ cities. Food brands in India are increasingly turning to smart collaborations to boost visibility, spark consumer excitement, and drive long-term growth.

Food brands in India are increasingly turning to smart collaborations to boost visibility, spark consumer excitement, and drive long-term growth. From footwear to fashion, jewelry to lingerie, brands are rethinking how they connect with consumers in an era shaped by personalization, technology, and community-driven engagement.

From footwear to fashion, jewelry to lingerie, brands are rethinking how they connect with consumers in an era shaped by personalization, technology, and community-driven engagement. India’s jewelry market is undergoing a retail boom, with brands aggressively expanding through franchising, SiS formats, and omnichannel strategies. From Tier II & III cities to diaspora-driven global markets, players are racing to build footprints.

India’s jewelry market is undergoing a retail boom, with brands aggressively expanding through franchising, SiS formats, and omnichannel strategies. From Tier II & III cities to diaspora-driven global markets, players are racing to build footprints. From AI-driven carrier allocation to multimodal networks and omnichannel readiness, logistics leaders are rewriting their festive playbook to keep pace with the evolving demands of retailers and shoppers alike.

From AI-driven carrier allocation to multimodal networks and omnichannel readiness, logistics leaders are rewriting their festive playbook to keep pace with the evolving demands of retailers and shoppers alike. 84 percent of consumers believe frozen snacks allow them to enjoy restaurant-style food at home, while 73 percent say they taste just as good as freshly prepared meals.

84 percent of consumers believe frozen snacks allow them to enjoy restaurant-style food at home, while 73 percent say they taste just as good as freshly prepared meals. How India’s Retail Game is now about celebrity equity and skin in the game

How India’s Retail Game is now about celebrity equity and skin in the game From premium fashion accessories to home textiles and cookware, business heads are adapting their approach to resonate with diverse audiences, optimizing both offline and digital channels for reach, experience, and convenience.

From premium fashion accessories to home textiles and cookware, business heads are adapting their approach to resonate with diverse audiences, optimizing both offline and digital channels for reach, experience, and convenience. In this fast-evolving landscape, what defines success is not just product innovation, but the ability to create deeply personal and trust-filled relationships with consumers—both online and offline.

In this fast-evolving landscape, what defines success is not just product innovation, but the ability to create deeply personal and trust-filled relationships with consumers—both online and offline. While the supply side grapples with reconfiguration, the demand side has undergone a revolution of its own. According to Goel, consumer expectations have dramatically evolved over the past two decades.

While the supply side grapples with reconfiguration, the demand side has undergone a revolution of its own. According to Goel, consumer expectations have dramatically evolved over the past two decades. In this evolving narrative, new-age players like ace turtle, TMRW (an Aditya Birla Group venture), and HomeLane are not just navigating the change but shaping it through innovation, agility, and a deep understanding of their consumers.

In this evolving narrative, new-age players like ace turtle, TMRW (an Aditya Birla Group venture), and HomeLane are not just navigating the change but shaping it through innovation, agility, and a deep understanding of their consumers. The insights reveal a profound narrative of continuity, where traditions endure even as the channels and tools around them transform radically.

The insights reveal a profound narrative of continuity, where traditions endure even as the channels and tools around them transform radically. As Tier II, III and IV cities step into the spotlight, Bharat is no longer just a market on the rise — it's the epicenter of a billion-dollar consumption boom. From premium fashion to high-tech kitchenware, small-town India is redefining aspiration, acces

As Tier II, III and IV cities step into the spotlight, Bharat is no longer just a market on the rise — it's the epicenter of a billion-dollar consumption boom. From premium fashion to high-tech kitchenware, small-town India is redefining aspiration, acces In a digital economy obsessed with scale, a new breed of Indian startups is flipping the script. Instead of chasing the masses, they’re zooming in—on hyper-specific audiences, under-served needs, and razor-sharp relevance.

In a digital economy obsessed with scale, a new breed of Indian startups is flipping the script. Instead of chasing the masses, they’re zooming in—on hyper-specific audiences, under-served needs, and razor-sharp relevance. Levi’s commitment has always been to remain culturally relevant and deeply connected to its consumers. In India, this ethos takes on a powerful, localized form.

Levi’s commitment has always been to remain culturally relevant and deeply connected to its consumers. In India, this ethos takes on a powerful, localized form.